Thoughts on food inflation

The World Bank recently stated in a report that there is still a high level of domestic food price inflation worldwide. The increase in global food prices has been attributed by some media sources to the ongoing Russian-Ukraine conflict (see for example, this CNN article) since both countries are significant producers and exporters of wheat, which can affect the prices of bread, pasta, and other food items worldwide.

However, if you take a more detailed analysis of the data, it suggests that other factors besides the underlying commodity prices could be contributing to the rise in food costs around the globe.

For starters, wheat prices (as represented by CBOT futures) have settled back to pre-invasion levels as the market redistributed the available supplies and an agreement was reached to maintain the flow of wheat through the Black Sea. Wheat futures are currently traded at almost 20% lower than their pre-invasion levels.

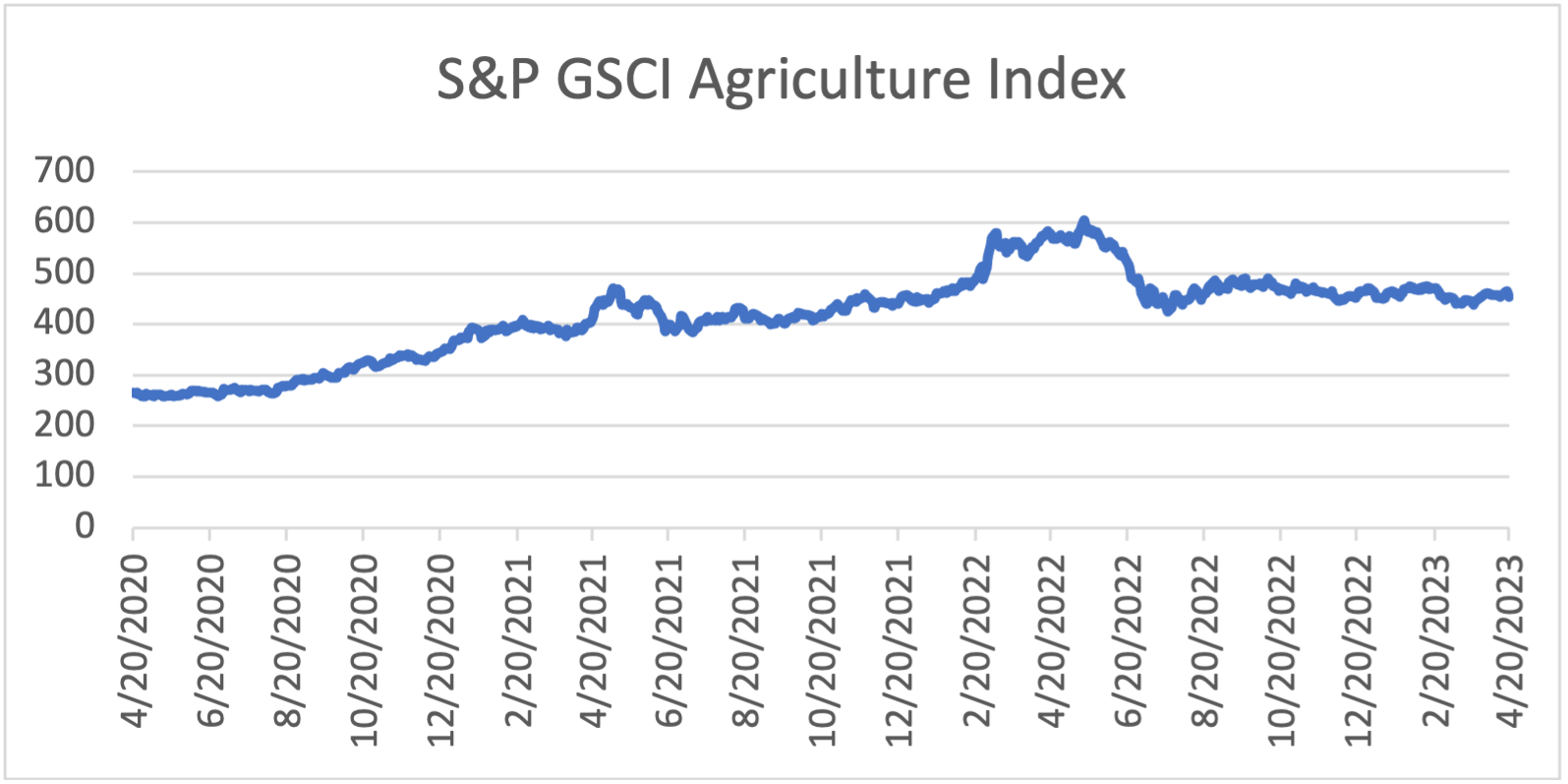

A similar pattern can be observed from a broader basket of agricultural commodities. The S&P GSCI Agriculture Index monitors the futures prices of all significant agricultural commodities such as grains, oilseeds, cotton, coffee, sugar, and others, and includes them in its benchmark index. As shown below, the prices of agricultural products across the board have also stabilized, either at or below the levels observed before the invasion.

If the prices of fundamental agricultural products are not the primary driver, then what is causing the rise in global food prices? One of the factors that contribute to this phenomenon is the robustness of the US dollar. Many of the most populous and rapidly expanding nations rely on imported commodities to satisfy their growing demands. While global prices in US dollars have stabilized, either at or below the levels observed before the invasion, the price of local currency in numerous countries has increased due to the strengthening of the US dollar versus domestic currencies. As a result, this reinforces the inflationary impact and puts pressure on domestic currency values, offsetting the positive effects of stable prices in the world market.

On the flip side, we actually start seeing food inflation stabilizing a bit in the US, and this has helped food businesses significantly. Chipotle, for example, is seeing relief on avocado costs, which in turn helped the company’s margins as it offsets higher costs for other items such as oils and tortillas.

What can we expect in the future? Commodity markets are entering a crucial phase, with the planting season in the Northern Hemisphere only beginning. The markets will monitor the successful sowing period to assess the production potential of wheat, corn, and soybean crops. In tropicals, the recent upswing in coffee, cocoa, and sugar prices will have a significant impact, particularly for sugar, where the market has reached its highest level in ten years. Although USD levels have somewhat moderated, they remain higher than pre-invasion levels, indicating that any substantial reduction in global food inflation may be a long way off.