World Bank Projects Food Price Decline, But Flags Geopolitical and Climate Risks

Sign up for Ag Commodities Focus: Stay ahead of the curve on ag commodities trends.

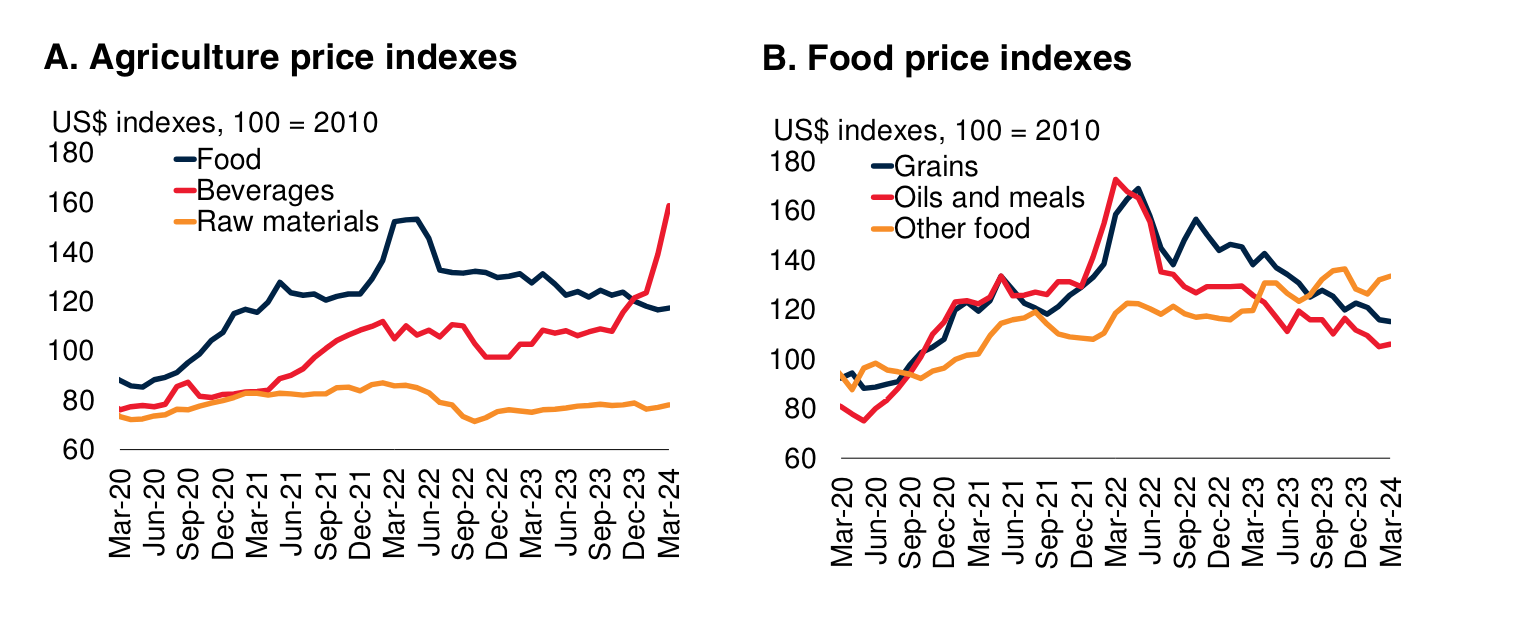

The World Bank anticipates a decline in global food prices throughout 2024 and 2025, primarily driven by lower prices for grains and oils. However, the latest report from the bank warns of potential risks, including geopolitical tensions and weather-related disruptions, that could impact this projection.

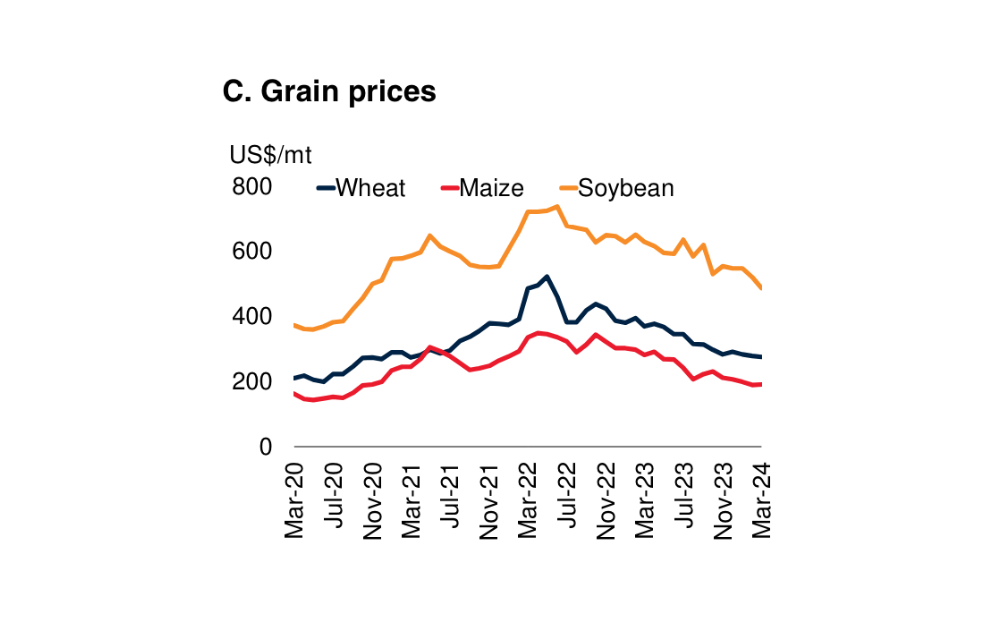

The report highlights recent trends such as falling maize and wheat prices due to increased production and exports from key regions. Wheat prices, in particular, are expected to experience a significant decline in 2024, primarily due to elevated global production and robust export competition.

The World Bank forecasts a 15% drop in wheat prices for 2024, reflecting the second-highest global production on record in the 2023-24 season, even with the discontinuation of the Black Sea Grain Initiative.

"The collapse of the Black Sea Grain Initiative had minimal fallout, as Ukraine has so far been able to continue exporting [wheat] via seaborne corridors and new overland routes," explains the World Bank.

Despite a slight rebound expected in 2025, wheat prices are projected to remain relatively low due to sustained export competition and only marginally higher production.

Similarly, the outlook for corn prices is also characterized by downward pressure, driven by record-high global production and ample stocks. The World Bank projects a significant decline in corn prices, with a projected 11% drop in 2024 and a further 4% decrease in 2025. This decline is attributed to increased global supplies and favorable harvest prospects. Notably, global maize production in the 2023-24 season is expected to reach an all-time high, further contributing to the downward trend in prices.

However, despite the projected decline in food prices, the report emphasizes the presence of significant risks. Geopolitical tensions, particularly disruptions to grain shipments through the Red Sea and Suez Canal, could lead to delays, increased shipping costs, and ultimately higher food prices.

"If attacks [on commercial vessels in the Red Sea] intensify, prompting vessels from the Black Sea to also divert, substantial delays, increased shipment costs, and higher prices could materialize," the report warns.

Weather-related risks also pose a threat to the projected food price decline. While the weakening of El Niño is expected to alleviate price pressures on commodities like rice and sugar, the potential emergence of La Niña could bring unpredictable weather patterns and impact agricultural production.