US Wheat Futures Mixed as Weather Concerns and Supply Dynamics Influence Market

Sign up for Ag Commodities Focus: Stay ahead of the curve on ag commodities trends.

US wheat futures experienced a mixed performance in the week ending May 3, 2024, as market participants focused on the impact of weather conditions on Northern Hemisphere crops and assessed global supply dynamics, according to the latest report from US Wheat Associates.

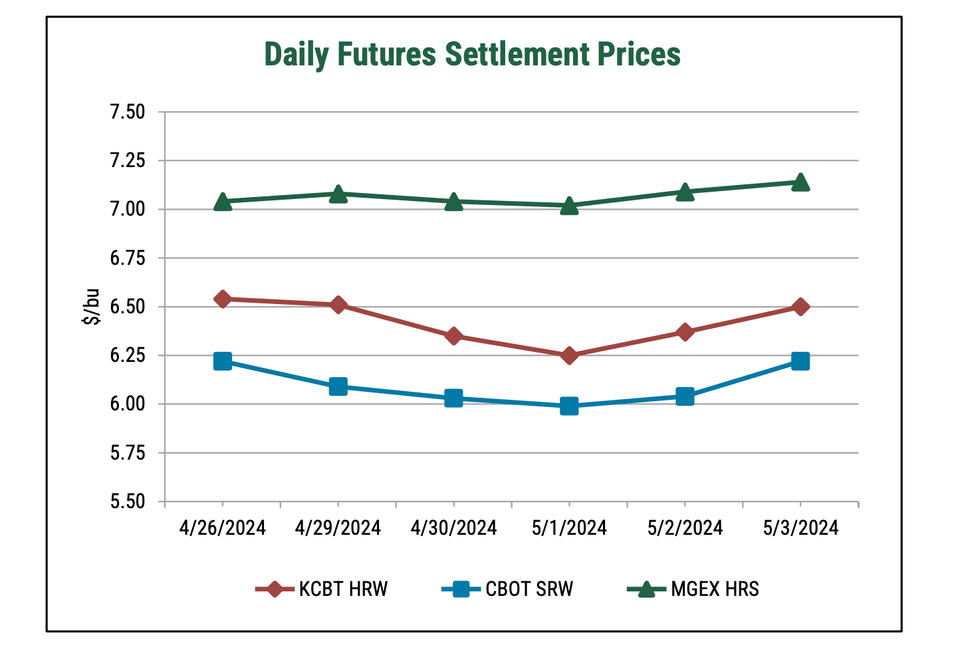

July 2024 CBOT soft red winter (SRW) wheat futures remained unchanged, closing at $6.22 per bushel, while KCBT hard red winter (HRW) wheat futures declined by 4 cents to $6.50 per bushel. MGEX hard red spring (HRS) wheat futures, on the other hand, saw an 11-cent increase, reaching $7.14 per bushel.

Basis values for different wheat classes were mixed, with HRS basis remaining flat in the Gulf and rising in the Pacific Northwest (PNW). HRW basis declined in both exporting regions, likely influenced by increased farmer selling due to the late-week price rally. SRW basis decreased slightly, while soft white (SW) wheat prices remained steady.

Net sales of US wheat for the 2023/2024 marketing year were down significantly, with a net reduction of 20,300 metric tons (MT) reported for the week ending April 25. However, total commitments for the marketing year remain at 97% of the USDA's projected export volume. Meanwhile, net sales for the 2024/2025 marketing year reached 406,900 MT, indicating strong early demand for next year's crop.

"The weekly USDA Crop Progress report rated 49% of the winter wheat crop in good to excellent condition, up significantly from 28% last year but down 1 point from the week prior," the report observes, highlighting the impact of weather on crop conditions.

Globally, concerns about dry conditions in Russia's southern crop-growing regions have led some analysts to revise their production forecasts downward. Additionally, a lawsuit filed by one of Russia's largest grain exporters against the country's agricultural watchdog has raised concerns about potential disruptions to exports.

"The Russian Hydrometeorological Centre state forecasting agency indicated that precipitation deficits in southern crop growing region may be a factor to monitor," the US Wheat Associates report warns. "In response to the dry conditions some private analysts have decreased Russian production to under 90.0 MMT in 2024/25."