Soybean Oil: A Leading Indicator for Crude Oil Prices?

Sign up for Ag Commodities Focus: Stay ahead of the curve on ag commodities trends.

A study published on Thursday by the CME Group suggests that soybean oil prices may be acting as a leading indicator for crude oil prices. This intriguing relationship could hold valuable implications for understanding the future trajectory of both markets.

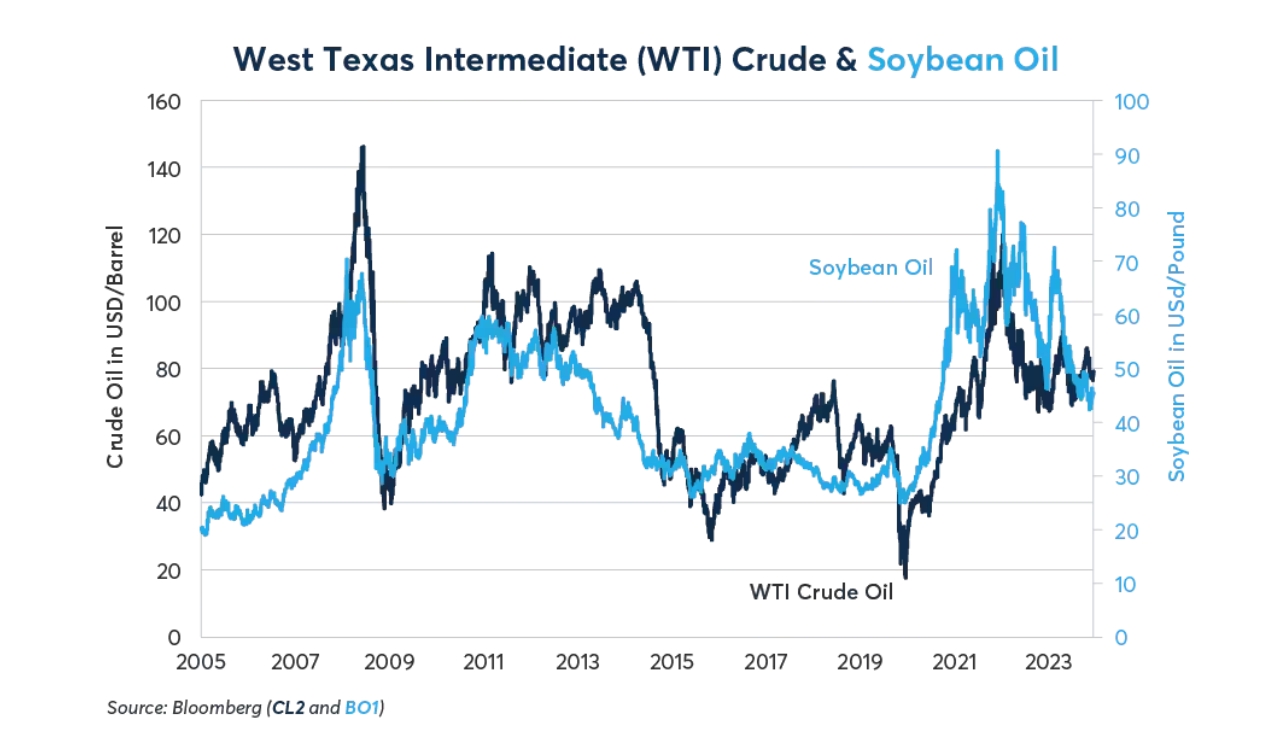

The CME Group's analysis highlights several instances over the past 15 years where soybean oil prices exhibited significant price movements that preceded similar movements in crude oil prices. This trend, dating back to the enactment of the US Energy Independence and Security Act (EISA) in 2007, coincides with a period of growing biofuel production from vegetable oils.

"The pattern of soybean oil leading crude oil prices didn’t begin in 2023," the CME Group analysis states. "It dates back to around 2007 when the U.S. Congress passed the Energy Independence and Security Act (EISA) which, among other provisions, required a gradual increase in renewable fuels such as ethanol and biodiesel, which can be produced from corn and soybean oil, respectively."

The analysis points to several instances where soybean oil prices surged or declined ahead of similar price movements in crude oil. This includes the 2007-2008 price rally, the 2008-2009 price decline, the 2010-2011 price rally, and the 2014-2015 price collapse.

Figure 1: WTI Crude vs Soybean, 2005 - present

“Since soybean oil has found increasing use as biodiesel, its price may be hypersensitive to insipient changes in crude oil’s demand and supply dynamics," the CME Group analysis explains.

The CME Group suggests that the relationship between soybean oil and crude oil prices could be attributed to the strategic decisions of major refining companies. These companies, with a broader perspective on global oil supplies and demand, may choose to adjust their use of biofuels based on their assessment of future crude oil availability.

"If they sense a potential shortfall in crude oil supplies relative to demand for refined products, they can supplement their crude oil supply with biofuels," the CME Group analysis continues. "Since the soybean market is roughly 1/25th the size of the crude oil market, it might respond by rallying in advance of a subsequent move in crude oil prices."

The analysis further explores a similar price relationship between palm oil, another significant biofuel source, and crude oil prices.

While the CME Group cautions that this apparent price relationship is not guaranteed to continue, the recent softening in soybean and palm oil prices suggests that crude oil and diesel prices may struggle to rally in the near term.