Palm Oil Production Inches Up, Stocks Tighten on Strong Demand

Sign up for Ag Commodities Focus: Stay ahead of the curve on ag commodities trends.

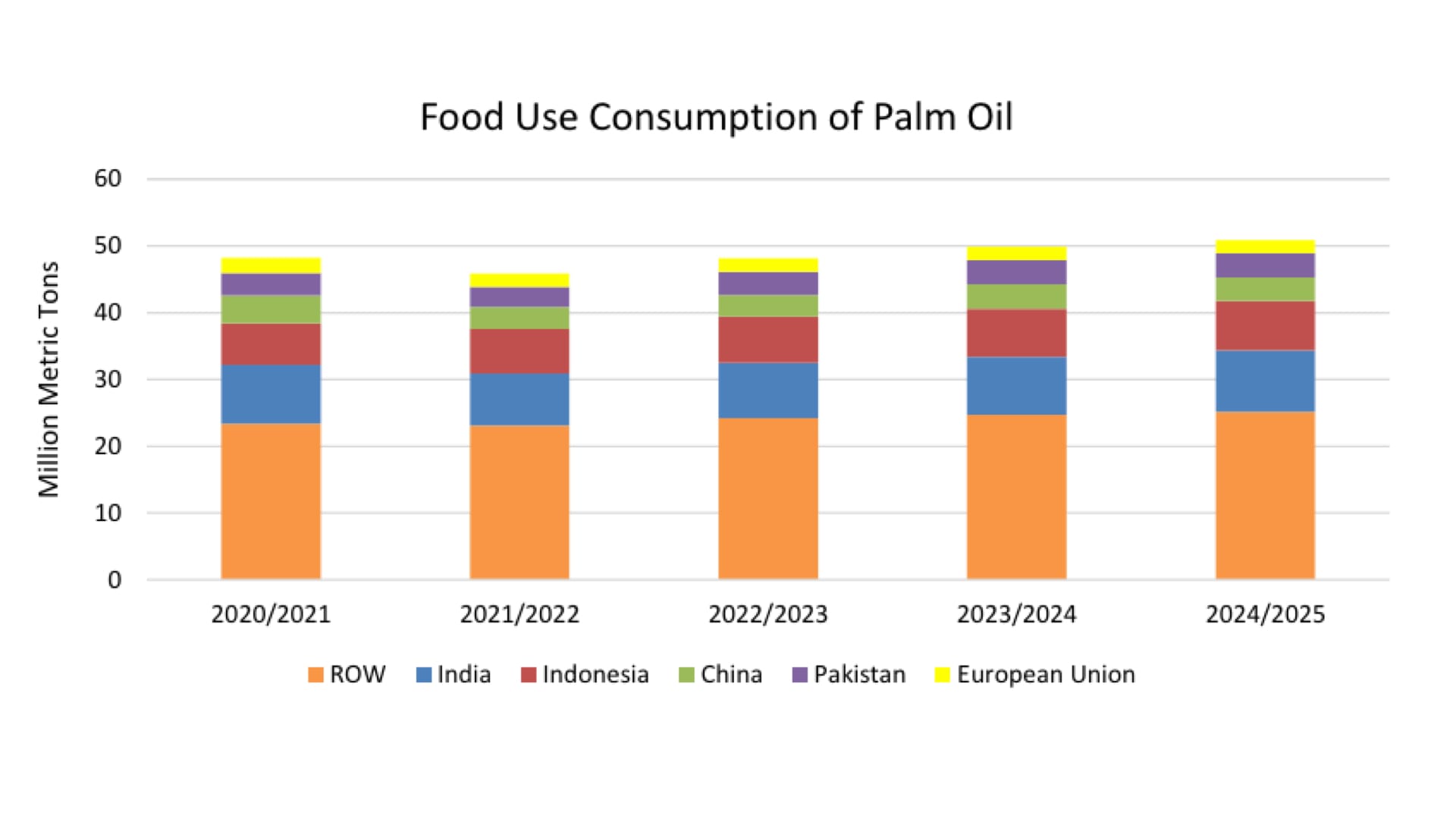

Global palm oil production is forecast to see a marginal increase in the 2024/25 marketing year, driven by improved weather conditions in major producing regions. However, despite the uptick in production, global palm oil stocks are expected to decline due to robust demand, particularly from India and Southeast Asia, according to a report by the USDA's Foreign Agricultural Service (FAS) published on Friday.

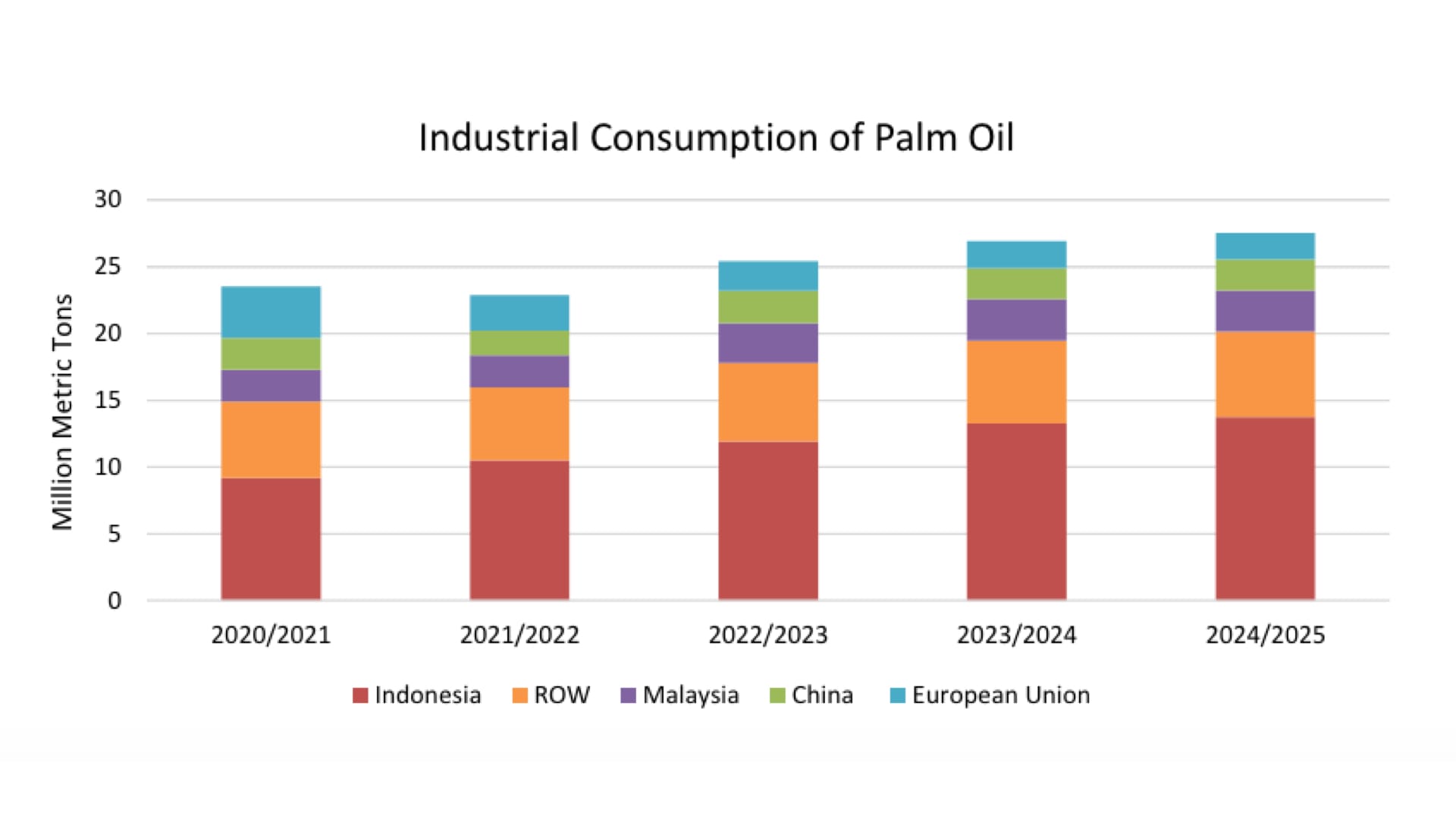

"Global palm oil production in 2024/25 is up marginally on improved weather conditions expected in Indonesia and smaller markets in South America," the report states. "Stocks are projected to shrink on heightened food use in India and industrial consumption in Malaysia and Indonesia."

Indonesia, the world's largest palm oil producer, is expected to see higher production thanks to improved weather conditions. However, the country's palm oil exports are projected to decline due to growing domestic demand, primarily driven by the continuation of the national mandatory B35 biodiesel production program.

"Indonesia palm oil domestic consumption is expected to have strong growth with a continuation of a national mandatory B35 biodiesel production program and raised domestic biodiesel demand leading to a decrease in exports despite higher production," explains FAS.

India, a major importer of palm oil, is forecast to see a rise in imports due to increasing food demand and the extension of reduced import duties on vegetable oils, including palm oil, until March 2025.

In contrast, imports by the European Union are projected to continue declining, reflecting changing consumer preferences and concerns regarding the health and sustainability of palm oil compared to other vegetable oils.

Malaysia, the world's second-largest palm oil producer, is expected to benefit from Indonesia's lower export volumes, with its exports projected to increase moderately.

The FAS report suggests a tightening global palm oil market in the coming year, with demand outpacing the modest production growth. This situation could lead to upward pressure on palm oil prices, particularly if weather conditions in major producing regions deviate from expectations.