Global Wheat Stocks Dwindle for Fifth Straight Year, Intensifying Export Competition

Sign up for Ag Commodities Focus: Stay ahead of the curve on ag commodities trends.

Global wheat stocks are projected to decline for the fifth consecutive year, reaching their lowest levels since 2015/16, as major exporting countries grapple with smaller harvests and robust demand, according to a report published by the USDA's Foreign Agricultural Service (FAS).

This tightening of global wheat supplies is expected to intensify competition among exporters and reshape trade patterns, with key players vying for market share in a landscape of shrinking inventories.

"Global wheat stocks are forecast to decrease for the fifth consecutive year to the lowest level since 2015/16," the report states. Global wheat stocks are projected to fall to 264.4 million tons, down from 266.7 million tons in the 2023/24 marketing year.

While China, the world's largest wheat producer, is expected to maintain relatively stable stocks at 138 million tons, major exporters such as Russia and the European Union are projected to draw down their inventories significantly. Russia's stocks are forecast to decrease from 18.2 million tons to 12.6 million tons, while the EU's stocks are projected to fall to 14.6 million tons.

"Among the major exporters, stocks are expected to decline the most for Russia, where production is forecast down while exports are forecast to remain robust," the report notes. "EU stocks are forecast down on less production and imports."

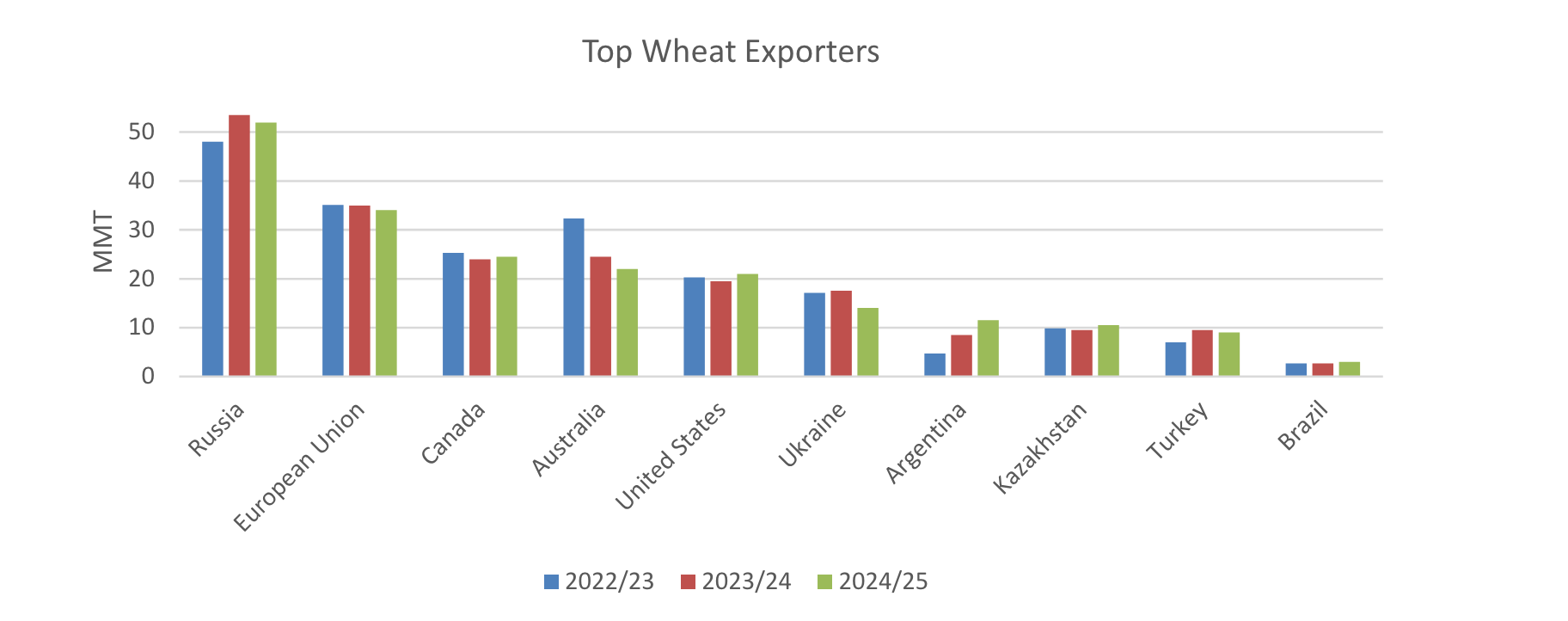

The dwindling global wheat stocks are expected to have significant implications for global trade flows. Russia, despite a smaller harvest, is projected to remain the world's top exporter for the fifth consecutive year, shipping an estimated 44 million tons of wheat. However, this represents a 1.5-million-ton decrease from the previous year. The EU and Ukraine are also facing export declines, with shipments projected to fall by 1 million tons and 3.5 million tons, respectively.

Conversely, high-quality wheat suppliers like Canada, Australia, and the United States are expected to see increased export opportunities due to larger harvests. The US is projected to export 22 million tons, up 1.5 million tons from the previous year.

"Competition is expected to remain fierce between Russia, the European Union, and Ukraine for trade year 2024/25 (July/June)," the report emphasizes. "With smaller exportable supplies, Russia, the EU, and Ukraine will draw down their stocks and battle for market share in Middle East and Africa, where strong growth in import demand is anticipated."