China's Wheat Production Poised for Record High as Consumption Stays Steady

Sign up for Ag Commodities Focus: Stay ahead of the curve on ag commodities trends.

China's wheat production is set to reach a record high in the 2024/25 marketing year, driven by favorable weather conditions and strong yields, according to a report published by the USDA's Foreign Agricultural Service (FAS) last week.

The report projects China's wheat output to reach 140 million metric tons (MMT), a 2.3 MMT increase from the previous year and 3.9% above the five-year average. This record production is attributed to a slight increase in planted area and a projected record-high yield.

"The USDA forecasts China’s marketing year (MY) 2023/24 wheat production at a record 140.0 million metric tons (mmt), up 2.3 mmt or approximately 1.7 percent from last year, and up approximately 3.9 percent from the 5-year average of 134.8 mmt," the report states.

Favorable weather conditions throughout the growing season have played a key role in boosting production prospects. Soil moisture levels were generally adequate during planting and the critical grain-filling stages, while favorable harvesting weather is anticipated.

"Overall, the winter wheat season’s soil moisture conditions during planting were characterized as wet-to-normal across the major growing regions including Henan, Hebei, Shandong, Anhui, and Jiangsu provinces," the report notes.

Additionally, farmers have been incentivized to maintain or slightly expand wheat acreage due to strong economic returns, despite rising input costs. The Ministry of Agriculture reported an 18% increase in input costs (seed, pesticide, and fertilizer) per hectare in Henan province, which accounts for a quarter of China's wheat production, in the 2022/23 marketing year.

The report also indicates that China's wheat consumption for food use is expected to remain stable in the 2024/25 marketing year, with flour mills accounting for around 75% of harvested wheat for flour production each year.

"[We forecast] MY2024/25 wheat consumption for food use to remain stable," the report states.

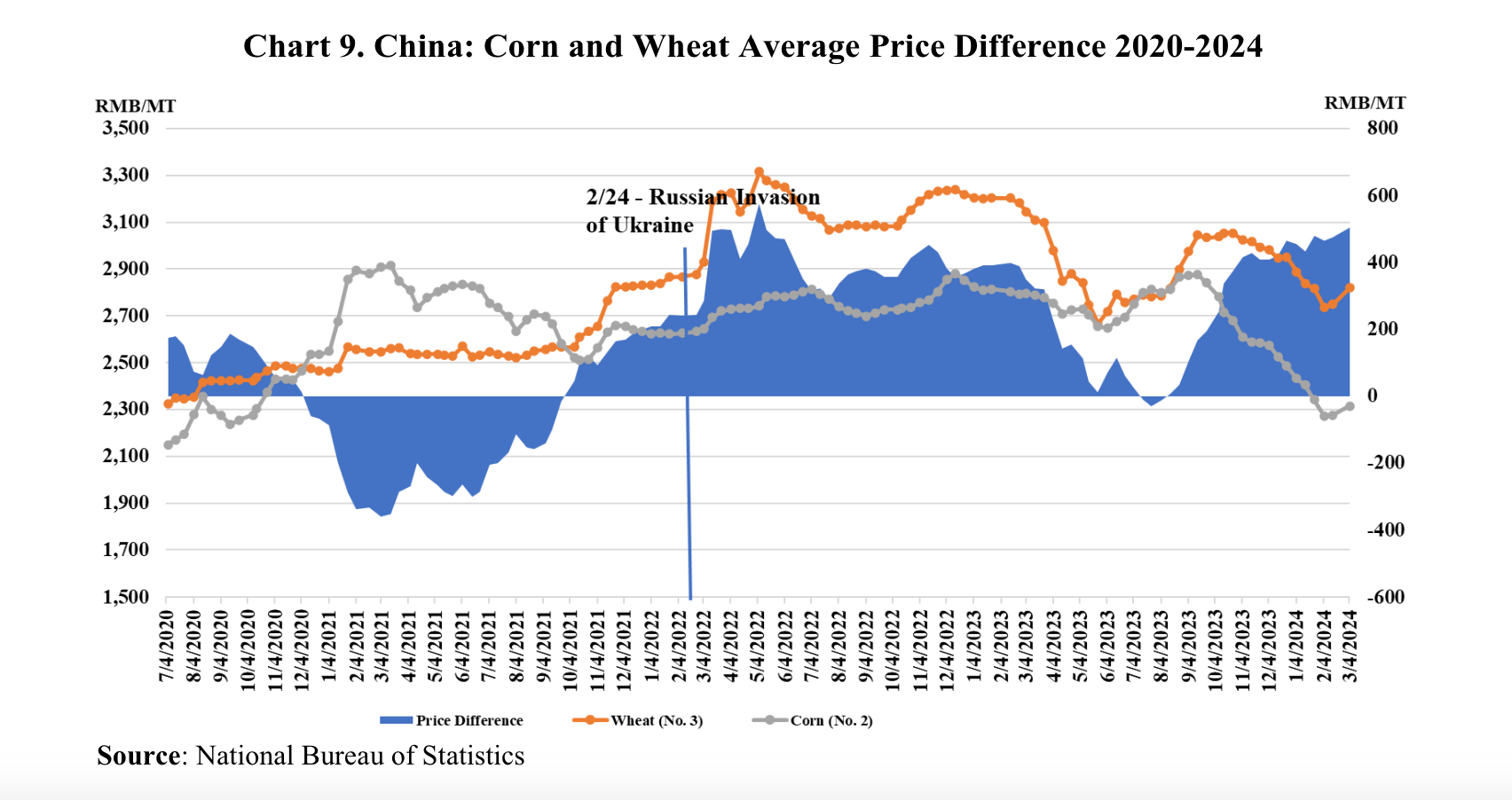

However, the report highlights a widening price difference between corn and wheat, with falling corn prices and relatively stable wheat prices. This widening gap suggests that wheat will not be as competitive as corn for use in animal feed rations.

"The wheat-corn price gap continued to widen during the first quarter of 2024 and is roughly $69 (RMB 500) per MT," the report explains. "With corn prices continuing to fall, wheat is not expected to be price competitive with corn in feed rations for the upcoming MY2024/25."

China's wheat ending stocks in the 2024/25 marketing year are forecast to be slightly higher than in the 2023/24 marketing year. Industry estimates place end of December 2023 temporary reserves at 37 MMT, slightly lower than last year.

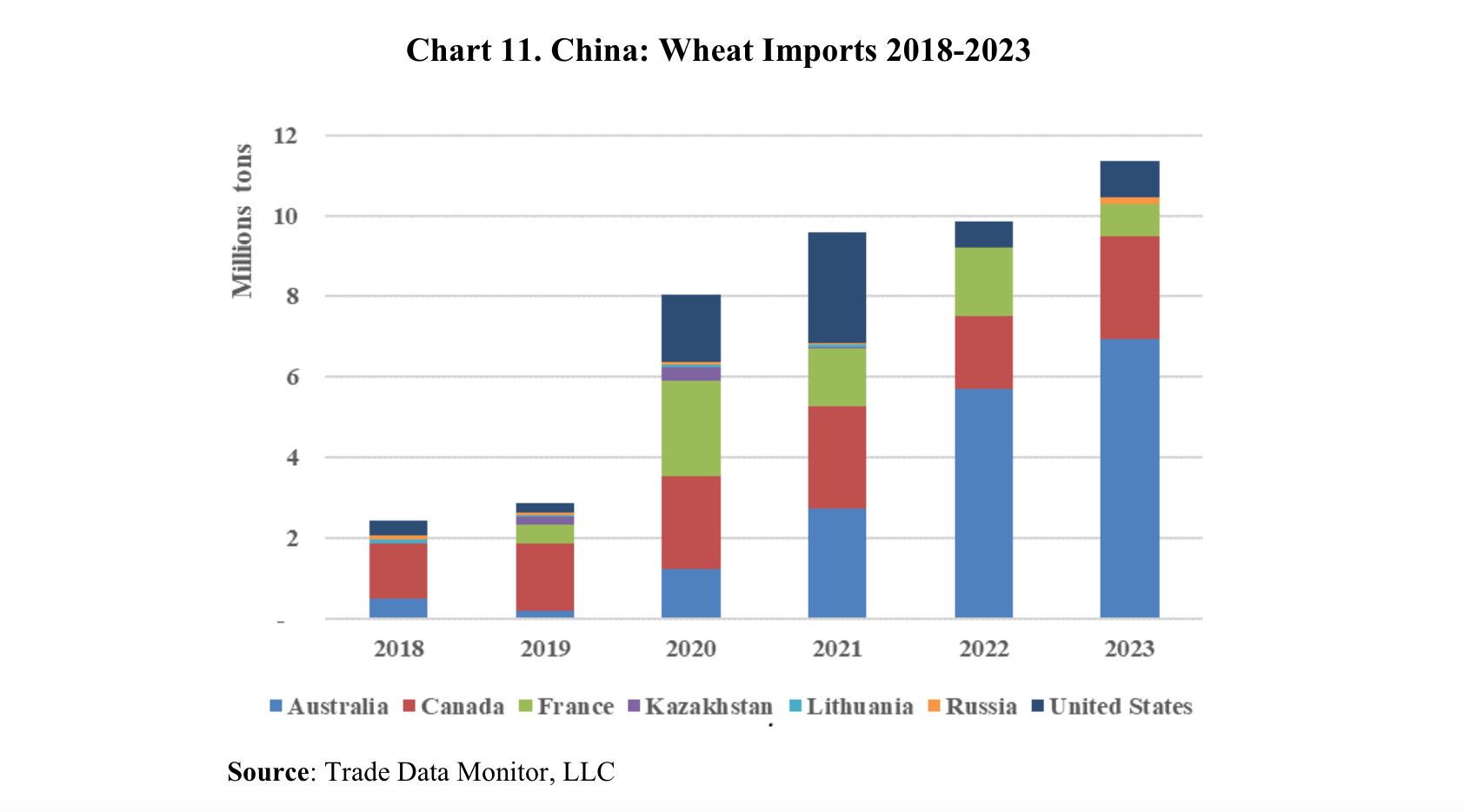

China's wheat import volume in the 2024/25 marketing year is forecast to remain relatively stable, with a potential for increased diversification of suppliers. The report notes that Chinese buyers have recently cancelled a significant volume of wheat imports from the US, Australia, and France, indicating price-driven adjustments in their purchasing strategies.

"The 2024 MSP for wheat procurement was set at $332 (RMB 2,360) per MT, up from $330 (RMB 2,340) per MT in 2023," the report concludes.

The robust wheat harvest and stable consumption levels, coupled with the ongoing implementation of the Minimum Support Price (MSP) program, suggest a positive outlook for China's wheat market in the coming year.