Australian Wheat Production to Remain Steady, Exports to Ease Amidst Stock Drawdown

Sign up for Ag Commodities Focus: Stay ahead of the curve on ag commodities trends.

Australia's wheat production is expected to remain relatively stable in the 2024/25 marketing year, despite contrasting seasonal conditions across the country's eastern and western production regions, according to a recent report by the US Department of Agriculture's Foreign Agricultural Service (FAS).

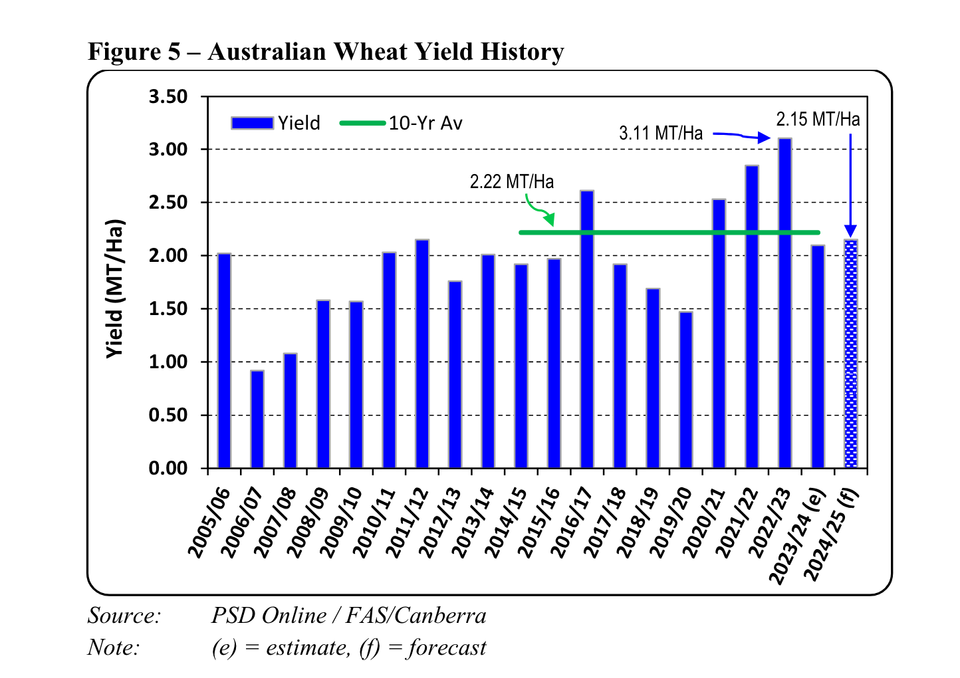

The FAS forecasts wheat production to reach 25.8 million metric tons (MMT), a slight decrease from the previous year and 3% below the 10-year average. This projection reflects a decline in planted area and slightly below-average yields.

"FAS/Canberra forecasts wheat production to remain relatively flat at 25.8 MMT in MY 2024/25, three percent below the previous 10-year average of 26.6 MMT," the report states.

Eastern Australia has experienced favorable conditions with average to above-average rainfall, leading to good soil moisture levels at the start of the planting season. However, Western Australia and South Australia have faced dry conditions and are awaiting crucial autumn rains to support planting efforts.

"The eastern states of New South Wales, Victoria, and Queensland have generally received average to above-average rainfalls from the start of 2024, which has led to very good root zone soil moisture at the start of planting," the report explains. "Western Australia and South Australia have entered the start of the planting period with below-average root zone soil moisture and have yet to receive fall rains to get the winter planting going in earnest."

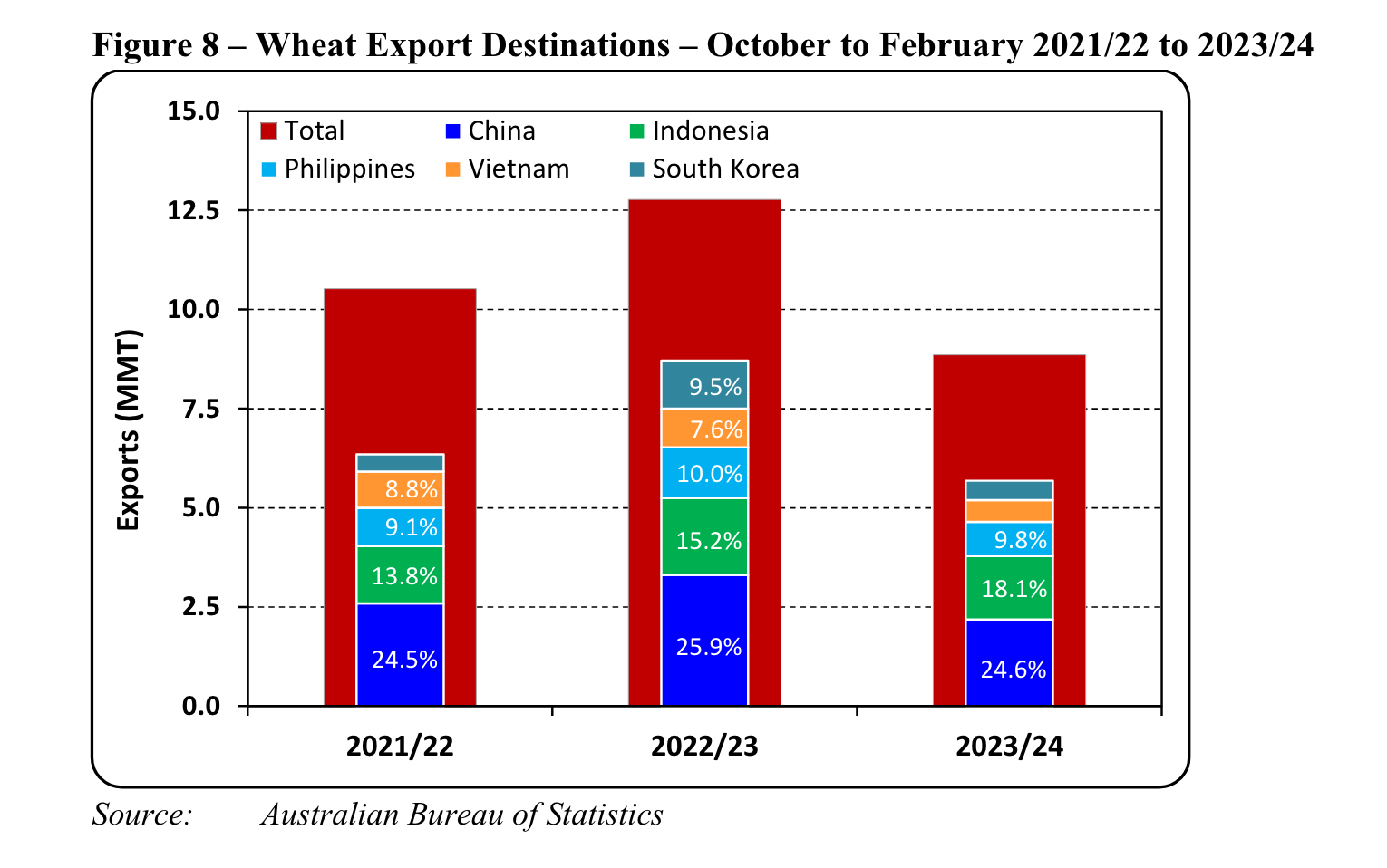

The FAS anticipates wheat exports to decline to 17.5 MMT in the 2024/25 marketing year, down from the estimated 20 MMT in the previous year. This decrease is primarily attributed to a drawdown of stocks in response to strong global demand. While China remains Australia's largest wheat export destination, accounting for around 25% of total exports, Indonesia, the Philippines, Vietnam, and South Korea also represent significant markets for Australian wheat.

Australian wheat consumption is expected to remain relatively stable, with the FAS forecasting a slight increase to 8.0 million metric tons (MMT) in the 2024/25 marketing year. This is primarily driven by a projected rise in livestock feed consumption, offsetting the stable demand for milling wheat. Favorable weather conditions in recent years have resulted in good pasture production and fodder reserves, contributing to steady demand from the livestock sector. While Australia's rapid population growth may eventually impact milled flour demand, no significant changes are anticipated in the near future.

The report notes that Australia's wheat ending stocks are expected to recover slightly in the 2024/25 marketing year after being depleted due to robust export demand. However, ending stocks are projected to remain below typical levels.