As India Surpasses China in Population, What Are the Implications for the Ag Trade?

Sign up for Ag Commodities Focus: Stay ahead of the curve on ag commodities trends.

Author: Doug Christie

India recently overtook China as the world’s most populous country. One in three people on the planet now reside within the borders of the two nations. The media frenzy surrounding the revelation focused on the economic implications of India’s newly found status, with some experts declaring a shift in the center of gravity for the global economy from China to India. Few, however, have delved into the impact India’s position as population leader may have on the commodity markets. Yet, the implications will be significant.

Since the dawn of the Malthusian specter, population growth has been associated with a reduction in living standards. As the theory posed, populations always grow faster than the resources required to feed them. Concerns about population growth outstripping production and deferring greater prosperity have historically featured in the national policies of both India and China. Within five years of gaining independence, India enacted a national program to limit population growth linked directly to the national economic plan. While the initial implementation was fraught with controversies and excesses, the attempt to manage population growth as part of overall economic development shows the criticality of the relationship and family planning remains a focus area for Indian policymakers. In the same way, China has paired population and economic growth in its national planning process, most notably with the ‘’one-child policy”. Initially written into the country’s constitution in 1982, the policy was progressively relaxed over subsequent years and lifted entirely in 2021.

The more constructive response to the Malthusian constraint is development and innovation and here both countries have been relatively successful – China compellingly so. Combining economic growth with an openness to trade has propelled China to become a top importer of agricultural products, ensuring an increasingly advanced diet for its growing population. It is now vital to ascertain whether India can replicate this pattern to rival China as a global agricultural importer. That assessment hinges on three critical factors: income growth, consumption patterns, and global market participation.

Income

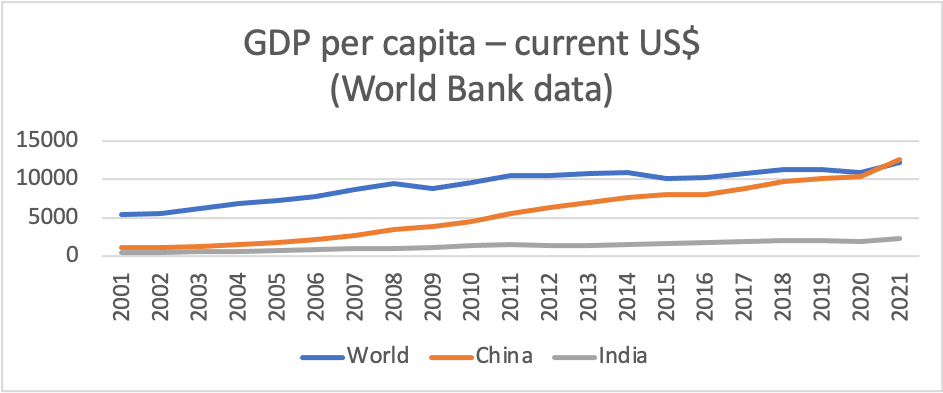

Over the past two decades, the pace of economic growth in China has enabled a major increase in individual standards of living despite overall population growth. From 2001 to 2019, China’s economy grew at an annual average pace of 9.1%, propelling personal income from just over $1,000 per person to levels above $10,000. India’s income growth has also maintained an upward trajectory but at a much slower pace than that observed in China, with an average annual growth of 5% over the same period. With this, India was able to push per capita income to just over $2,000. Meaningful growth to be sure, but not yet at a level to match China and still well below world GDP levels of $11,000 per capita. India’s income is now at a comparable level to where China ramped up its import buying, but India will need to grow faster than its demonstrated historical rates if it is to have a similarly outsized influence on global agricultural trade.

Consumption patterns

Rising incomes move diets away from basic foods towards higher-value and more processed food items. Exponential increases in higher-value food consumption take hold as incomes grow from $1,000 and $10,000 before plateauing above $20,000. The greatest share of the enrichment of Chinese diets has come in the form of increased meat consumption. This is seen most clearly in the growth of the livestock feeding industry in China. Fueled by imports of corn and soy, Chinese facilities increasingly produced chicken and pork to satisfy local consumers. This domestic meat output was eventually supplemented with meat imports as well. To see meat become such a large component of diet expansion in China should come as no surprise. China has a long-established meat-consuming culture and small households have been backyard feeding animals for centuries. The transition to larger-scale commercial feeding is a logical evolution. The Chinese consumer has not been the only beneficiary of this growth. It has been transformative for agri-business globally, most notably in the US and Brazil, where expansion in crop production, processing and handling has been initiated in response to Chinese demand.

As India approaches the threshold where income growth most directly impacts food consumption, it is important to look at what products will be most demanded, and to what magnitude. For religious and cultural reasons, India is unlikely to follow China on the path to commercial meat production. Two of India’s predominant religions – Hinduism and Buddhism – both espouse vegetarianism. And while not all practitioners strictly forego meat, a culture of meat production is far less entrenched in India. Unlike the ubiquitous “wet market" in China, Indian outlets seldom feature physical evidence of meat production, even if the output is available. Without commercial livestock as a driver, India is unlikely to tip the trade flows in corn and soy – the second and third most shipped grains by volume globally. If India is to impact trade flows on the scale China has, it will be through items already entrenched in Indian culture and cuisine.

Trade attitude

It is not a coincidence that the initial ramp-up in Chinese agricultural imports was marked by China’s entry into the World Trade Organization. Shortly after joining the WTO in 2001, China began to seek international trade (and eventually investment) partners to augment its domestic food production. Over subsequent years, trade in several key commodities was bolstered through the issuing of import licenses, WTO administered Tariff Rate Quotas (TRQ) and State Reserve purchasing to build strategic stockpiles. While not without controversy, the implementation of this multi-pronged approach greatly accelerated the flow of commodities into China.

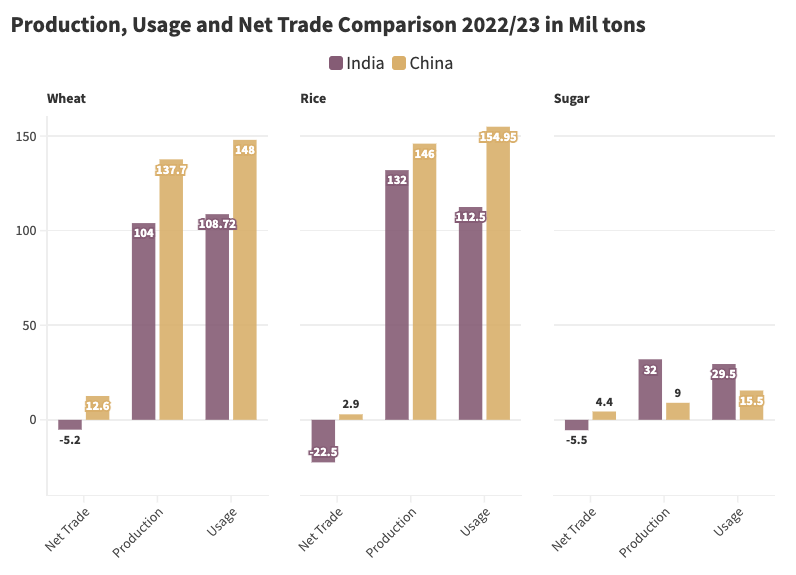

India, a WTO member since 1995, has been a less consistent buyer in the global commodity markets. The contrast between India and China’s approaches to trade can be illustrated in three key commodities – wheat, rice, and sugar. Both countries are major producers of each product. China and India rank first and second, respectively, in both global wheat and rice production and fifth and second in global sugar production.

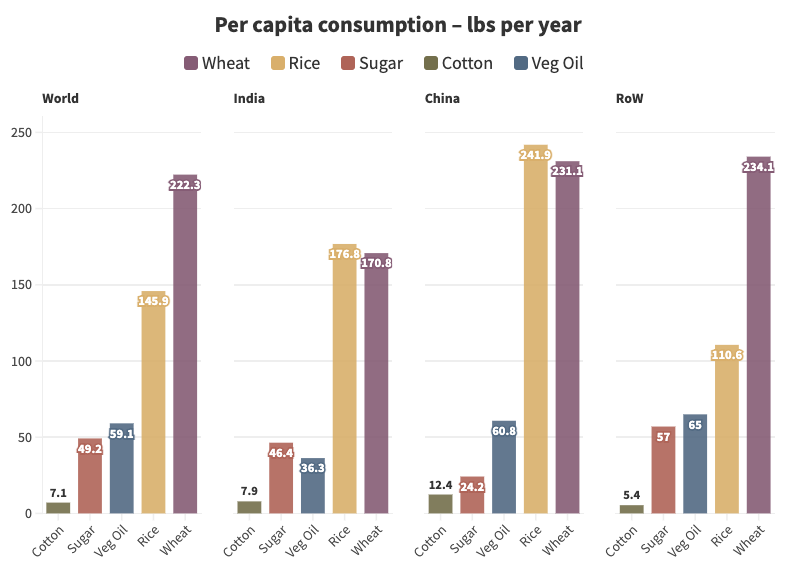

A look at their global trade balance in each product tells an interesting story. China has bolstered its domestic production with imports to the extent that the country consumes above world per capita levels in both grains, while still trailing world consumption levels in sugar. In contrast, India has pursued export-promotion schemes for all three products, even while consuming below world average levels in wheat and sugar. In rice, India does consume above world per capita averages but well below levels seen in other rice-producing nations like Thailand and Vietnam.

The divergence in trade approach between India and China can be attributed to two constraints – logistics and domestic politics. 94% of China’s population lives in the eastern half of the country and nearly one-third of the total population resides within 100km of the coast, highly accessible to imports. China has leveraged this natural advantage with a significant program of domestic and foreign investment in port-based handling and processing infrastructure for imported agricultural products.

By contrast, India is densely populated throughout its entirety with over 80% of the land mass occupied at a density greater than 100 inhabitants per square kilometer. Large portions of the population are geographically removed from domestic production surpluses and import gateways. India has less established infrastructure to move surpluses within its borders and less infrastructure to connect its interior with import entry points, especially for bulk commodities. This creates barriers to serving the interior population with affordable grain – domestic or imported.

That inherent logistical challenge is complicated by a complex web of farm supports, export incentives and consumer price-stability measures. Minimum support prices are routinely instituted for wheat, rice, oilseeds, cotton and other farm products. These MSPs are derived domestically, untethered from the world price level and have customarily increased year over year – good for farmers but not effective at communicating global price signals. To partially insulate consumers, the government has also implemented subsidized domestic distribution of key commodities. Good for consumers perhaps, but also a barrier to making much-needed investments in the logistics and infrastructure required to more economically transport grain to where it is most needed in the country. As surpluses have accumulated, the government has instituted direct and indirect export subsidies to clear supplies. The pace of this seemingly counter-productive cycle is regulated primarily by political expediencies as impacted parties compete to sway decision-makers. In the 2021/22 crop year Indian wheat exports topped 8 million tons, a record for the country at least partially attributed to the established MSP and export-subsidy regimens. In June of 2022, as global inflationary pressures mounted, Indian authorities announced a ban on wheat exports from the country. With this dynamic in play, it seems unlikely India will commit to a full-fledged policy of widespread agricultural imports.

India is likely to have an outsized impact on global markets in areas where its growing population and rising incomes align with cultural cuisines and a political willingness to engage with global markets. The commodity categories which best fit the criteria are vegetable oil and pulses.

In a similar way to early Western farmers rendering fat from hunted and raised animals, Indians have relied on ghee (clarified butter) to serve as an ingredient and cooking medium for their traditional cuisine. Over time, that was supplanted by manufactured vanaspati and now refined vegetable oils. To meet this demand, India has increased its oilseed crops and now produces 9 million tons of oil from domestic seeds. It has also consistently relied on world markets to source vegetable oil in increasing volumes and varieties. At over 14 million tons annually, India is now the largest global importer of total vegetable oil – number one in palm oil and sunflower oil imports and near the top in soybean oil. Despite this, per capita oil consumption in India lags world averages by a significant amount. To match current global consumption patterns for its current population, India would need to double its vegetable oil imports to 28 million tons! Daunting to be sure but illustrative of the magnitude of the opportunity. It is also worth noting that in addition to real consumption increasing at higher income levels, usage and loss of oil also increases as more food is consumed in further processed and out-of-home applications. Taken together with inevitable population growth, the case for India to impact vegetable oil markets in a major way is compelling.

Protein in the form of meat is not likely to be as impactful in India as it has been in China, but increased protein consumption will feature in the evolution of Indian diets, with global pulses the beneficiary. Pulses readily fit the criteria required to support explosive growth. India is already a leading producer of its own pulse crop and is supplementing that with significant imports. India is the leading producer of pulses in the world and tops the list of importers with 9 million tons purchased annually. Given India’s current leadership position in pulse usage it is more difficult to extrapolate from global averages to estimate future consumption, but China’s transformation can be illustrative. In the move from $2,000 per capita income levels to $4,000, Chinese per capita meat consumption increased by roughly 1.8 kg annually. A 1 kilo per capita increase in Indian pulse consumption equates to an incremental 14 million tons of annual pulse demand! It is also worth noting that pulses feature not only in vegetarian Indian diets but also as an accompaniment on meat-consuming menus.

Food evolution in India will likely play out in a distinctly different manner than in China. A slower pace of economic growth argues for a less explosive trajectory while historical taste and cultural differences, along with political challenges, suggest that India’s impact will not be in the most predominant globally traded products. But the demographic driver of a growing population and the well-established pattern of translating increased spending power into a richer diet will result in India engaging in a highly impactful way with selected agricultural markets. The global soy complex was transformed by China’s rise. Canadian pulse farmers and Indonesian palm growers may see similar outcomes as India passes China as the world’s most populous nation.

This content is for educational purposes only and is NOT financial advice. Before acting on any information you must consult with your financial advisor.