How Has China’s Demand for Soybeans Changed Over the Past Decade

Sign up for Ag Commodities Focus: Stay ahead of the curve on ag commodities trends.

China is the world’s largest importer of soybeans, and the country's demand for soybeans has undergone significant changes over the past decade, influenced by various economic, agricultural, and geopolitical factors. Below is a detailed breakdown of how China's soybean demand has evolved over time:

China's Soybean Imports

- Historical Growth: From 2000 to 2020, China's soybean imports increased dramatically from 10.4 million tonnes to 100.3 million tonnes, an 8.6-fold increase. This growth was driven by rising domestic demand for soy products, particularly for animal feed and edible oils.

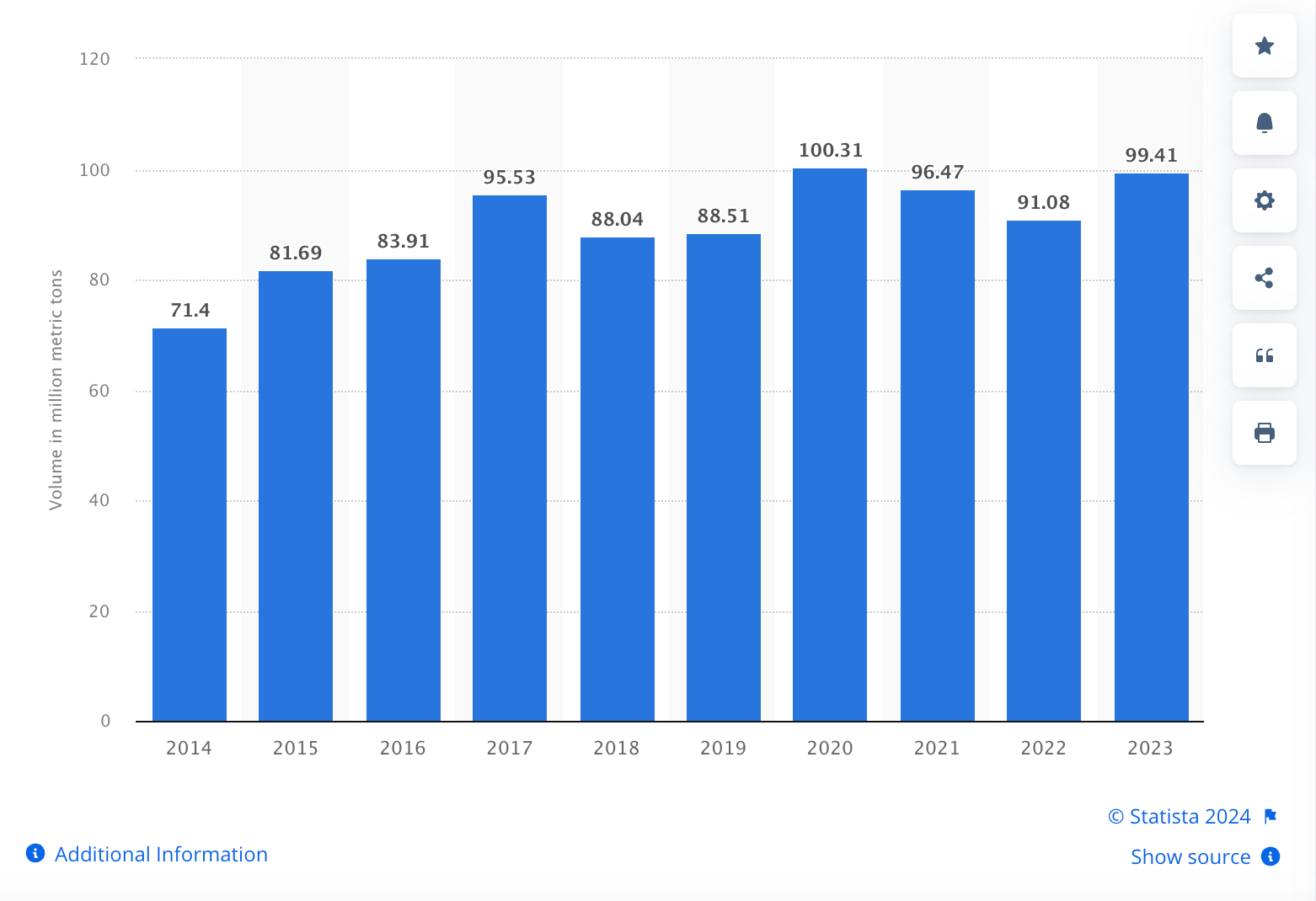

- Peak Imports: In recent years, China's soybean imports have ranged between 88 million and 100 million tonnes annually, accounting for around 60% of global soybean trade.

Chart: Import volume of soybeans in China from 2014 to 2023(in million metric tons)

Factors Influencing Demand

- Dietary Shifts: The increase in soybean imports has been largely driven by dietary shifts in China towards more animal protein, which requires significant amounts of soybean meal for animal feed.

- Trade Wars and Tariffs: The US-China trade war had a notable impact on soybean trade. In 2018, China imposed a 25% tariff on US soybeans, leading to a significant drop in imports from the US and a shift towards Brazilian soybeans.

- Price Competitiveness: Brazilian soybeans have often been more price-competitive compared to US soybeans, especially during periods of bumper crops in Brazil. This price advantage has led to increased Brazilian exports to China.

Recent Trends and Future Projections

- Slowdown in Growth: There has been a slowdown in the growth of China's soybean demand. Factors such as improved farming practices, slower livestock production growth, and a shift towards lower soymeal inclusion in animal feed have contributed to this trend.

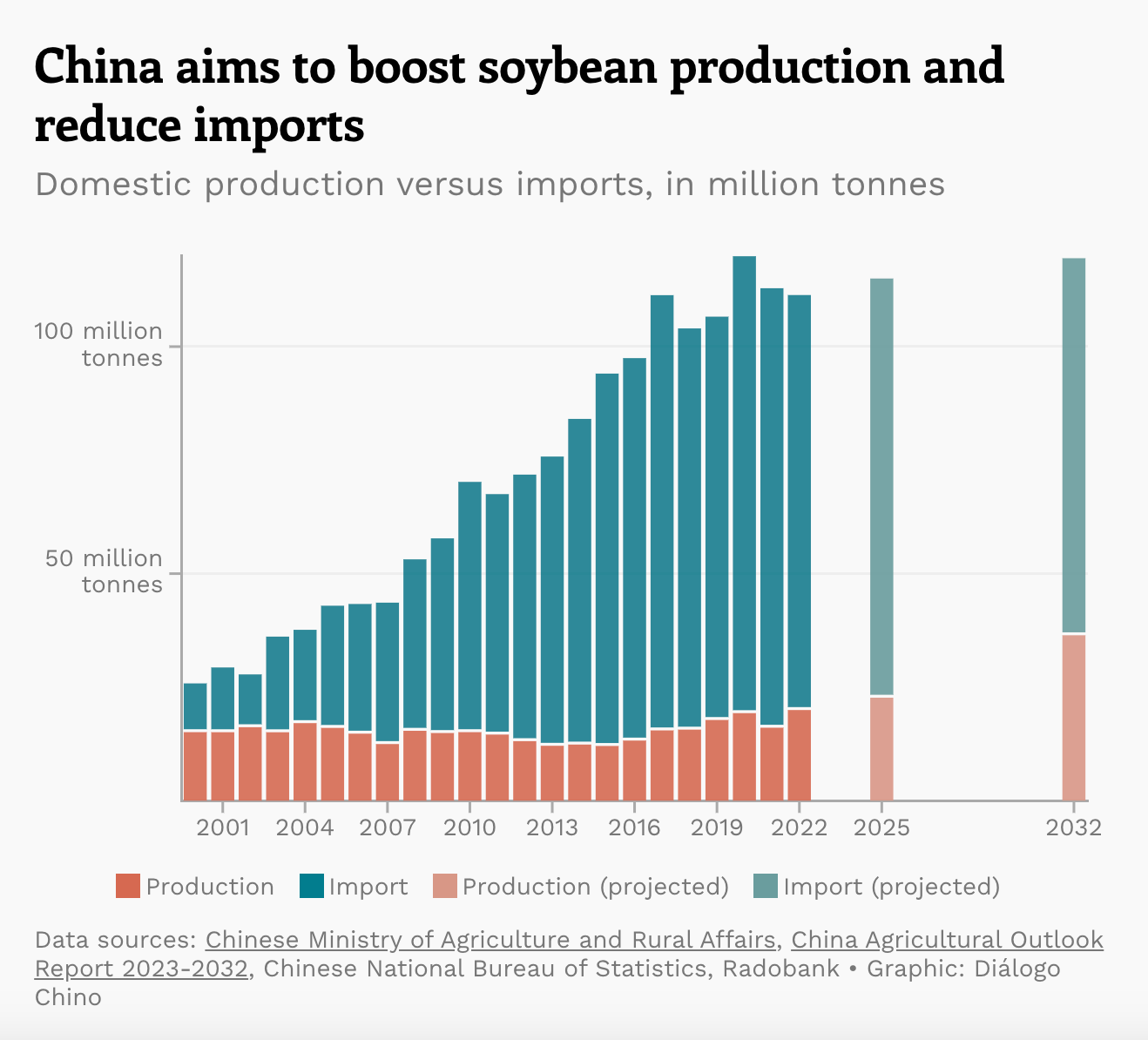

- Domestic Production Goals: Driven by food security concerns, China has been working to boost its domestic soybean production to reduce reliance on imports. The 14th Five-Year Plan targets an increase in domestic production to 23 million tonnes by 2025, with further goals to reach 36.75 million tonnes by 2032.

- Long-term Outlook: Despite efforts to increase domestic production, China is expected to continue relying heavily on soybean imports. However, some analysts believe that China's soybean imports may have peaked and could decline through 2030 due to the aforementioned factors.

Impact on Global Soybean Trade

- Shift in Trade Partners: Over the past decade, China has increasingly sourced soybeans from Brazil and other South American countries, reducing its dependence on US soybeans. This shift has been driven by both price competitiveness and geopolitical considerations. For example, between April 2023 to April 2024, China's soybean imports amounted to 99.9 million metric tons, 71.5% of which was supplied by Brazil according to S&P Global data. This highlights the dominance of Brazil in China's soybean market.

- Global Supply Chain: Changes in China's soybean demand have profound impacts on the global supply chain. The country's efforts to diversify its sources and increase domestic production are likely to influence global trade dynamics in the coming years.

What Are the Main Reasons Behind China’s Efforts To Boost Domestic Soybean Production

China's efforts to boost domestic soybean production are driven by several key factors:

Food Security Concerns

- Over-reliance on Imports: China imports a significant portion of its soybeans, with imports accounting for about 85% of its domestic consumption in 2020. This heavy reliance on foreign soybeans raises concerns about food security, especially given the geopolitical and trade tensions with major suppliers like the United States.

- Strategic Self-sufficiency: The Chinese government aims to reduce this dependency to ensure a more stable and secure food supply. The 14th Five-Year Plan targets increasing domestic soybean production to 23 million tonnes by 2025, up from 16.4 million tonnes in 2021.

Economic and Political Stability

- Trade Tensions: The US-China trade war highlighted the vulnerabilities associated with relying heavily on imports from a single country. By boosting domestic production, China aims to mitigate the risks associated with such geopolitical tensions.

- Proactive Trade Position: Reducing reliance on imports allows China to take a more proactive stance in trade negotiations, potentially reducing the impact of political factors on its food supply.

Agricultural Policy and Innovation

- Government Initiatives: The Chinese government has implemented various initiatives to increase soybean production, including setting aside more agricultural land for soybean farming, intercropping soybeans with other crops, and improving farming practices to boost yields.

- Genetically Modified Soybeans: There are plans to promote the industrial application of genetically modified soybeans to enhance productivity and resilience.

Market Dynamics and Economic Efficiency

- Price Competitiveness: While Brazil has been a major supplier due to its competitive pricing, China aims to balance this by increasing its own production to avoid over-dependence on any single source.

- Domestic Demand: China's demand for soybeans remains high, driven by the need for soybean meal in animal feed and soybean oil for cooking. Even with increased domestic production, China is expected to continue importing large quantities of soybeans to meet its total demand.

Long-term Sustainability

- Climate and Environmental Factors: Increasing domestic production can also help mitigate the risks associated with climate change and global supply chain disruptions, ensuring a more resilient agricultural sector.

- Diversification of Supply Chains: By boosting domestic production, China can diversify its supply chains and reduce the potential impact of global market fluctuations and extreme weather events on its food supply.

How Will China’s Increased Soybean Production Affect Its Trade Relations With Major Suppliers Like the US And Brazil

China's increased soybean production is likely to have several significant impacts on its trade relations with major suppliers like the U.S. and Brazil. Below are some key points pointed out by industry analysts:

Reduced Dependence on Imports

- Diversification and Self-sufficiency: By boosting domestic soybean production, China aims to reduce its heavy reliance on imports from the U.S. and Brazil. This move is part of a broader strategy to enhance food security and mitigate the risks associated with geopolitical tensions and trade disruptions.

- Impact on Import Volumes: As China increases its domestic production, the volume of soybeans it needs to import may decrease. This could lead to a reduction in the market share of U.S. and Brazilian soybeans in China, potentially affecting the export revenues of these countries.

Trade Relations with the U.S.

- Geopolitical Tensions: The U.S.-China trade war has already strained trade relations, with China imposing tariffs on U.S. soybeans and shifting its purchases to Brazil. Increased domestic production could further reduce China's dependence on U.S. soybeans, potentially exacerbating trade tensions.

- Market Diversification: The U.S. has been diversifying its soybean export markets in response to reduced Chinese demand. This trend may continue as China boosts its domestic production, leading the U.S. to seek new markets to offset the decline in Chinese purchases.

Trade Relations with Brazil

- Brazil's Dominance: Brazil has become the dominant supplier of soybeans to China, benefiting from competitive pricing and increased production capacity. However, China's efforts to increase domestic production could challenge Brazil's market share in the long term.

- Supply Chain Adjustments: Brazil's soybean exports to China have surged in recent years, but increased Chinese production could lead to adjustments in the global supply chain. Brazil may need to find alternative markets or adjust its production strategies to maintain its export levels.

Economic and Strategic Implications

- Price Competitiveness: Increased domestic production in China could lead to changes in global soybean prices. If China reduces its imports, the global supply may increase, potentially lowering prices and affecting the profitability of soybean producers in the U.S. and Brazil.

- Strategic Partnerships: China may continue to diversify its soybean sources to include more countries, reducing its reliance on any single supplier. This strategy could lead to new trade partnerships and a more balanced global soybean market.

Long-term Outlook

- Sustainability and Resilience: China's push for increased domestic production is part of a broader effort to create a more sustainable and resilient agricultural sector. This move could lead to long-term changes in global trade patterns, with China playing a more self-sufficient role in the soybean market.

- Continued Imports: Despite efforts to boost domestic production, China is expected to continue importing significant quantities of soybeans to meet its total demand. The balance between domestic production and imports will be crucial in shaping future trade relations with the U.S. and Brazil.

See also: Soybean market news