Asia Sugar Market Faces Supply Constraints and Shifting Import Demand in Early 2024

Sign up for Ag Commodities Focus: Stay ahead of the curve on ag commodities trends.

The Asian sugar market enters 2024 navigating challenges posed by reduced sugarcane output and evolving import demand dynamics, according to a report by S&P Global.

The report highlights the impact of El Niño on sugarcane production in key Asian countries. Thailand's cane crush and sugar production estimates have been revised downward due to irregular rainfall patterns during the planting season. S&P Global forecasts Thailand's cane crush and sugar production for the 2023-24 marketing year at 85 million metric tons and 9.8 million metric tons, respectively, marking a decline from the previous year.

"Low rainfall during the sugarcane early growth stages contributed to the smaller production from the new crop," the report states. "Nonetheless, sugar exports for Thailand will still be smaller in 2024."

Similarly, India's sugarcane crop has also suffered from the effects of El Niño, with the 2023 monsoon rainfall hitting a five-year low. Market estimates for India's sugarcane production have been revised downwards due to concerns about lower yields. Additionally, uncertainty surrounding India's sugar export policy and government directives on ethanol production adds further complexity to the supply outlook.

"There is still no sugar export quota for the new crop, and I feel that this will not change until the election is over in May because the government needs to keep sugar prices at an acceptable level," an India-based source told S&P Global.

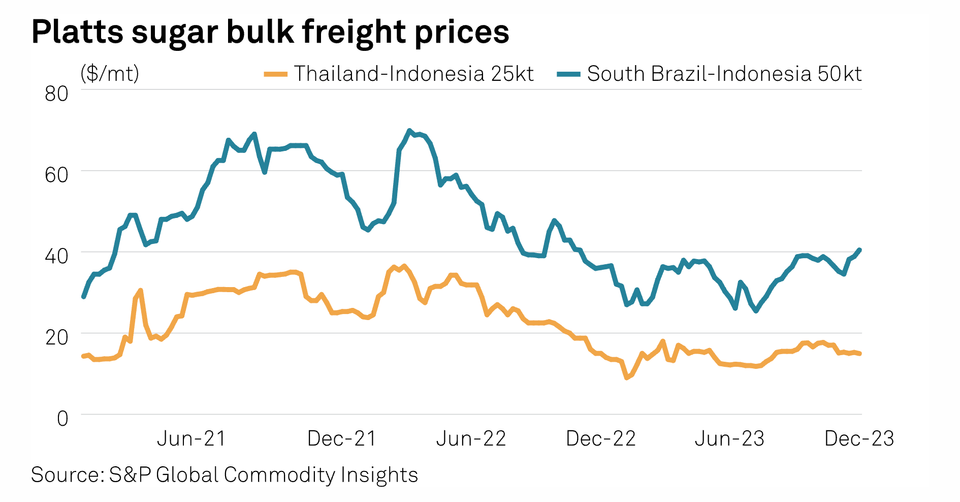

Indonesia, which saw a decrease in sugar imports in 2023 due to high global prices, is expected to increase imports in 2024 as prices moderate and the arbitrage for raw sugar imports becomes more favorable. Market expectations for Indonesia's 2024 sugar imports by refineries are around 3.6 million metric tons.

In contrast, the Philippines is looking to limit sugar imports to 200,000 metric tons in 2024, assuming no adverse weather events impact its domestic crop.

The Asian sugar market faces a complex interplay of supply constraints and evolving import demand. As major producing countries like Thailand and India grapple with reduced output, importing countries such as Indonesia are expected to increase their purchases. However, government policies and weather conditions remain key factors influencing the market's trajectory in the coming months.